Transfer Pricing Services

Our drive is to support you with transfer pricing services that meet your needs. We are here to introduce order and structure.

We’ve categorized our Transfer Pricing services in 6 categories. Learn more about these 6 categories and their underlying services, or check out all our Transfer Pricing services.

Transfer Pricing service categories

Transfer Pricing service categories

Quantera Global,

pleased to meet you!

Quantera Global is the largest independent transfer pricing boutique firm. We have a personal approach, global coverage and support our clients in the full circle of transfer pricing.

Our passion is to support our clients with solutions and to enable them to manage their transfer pricing challenges. To offer the best support it is essential to know and understand their needs.

As Abraham Lincoln once said: “If I only had an hour to chop down a tree, I would spend the first 45 minutes sharpening my axe”.

This may be a bit exaggerated, but this is how we prefer to do things at Quantera Global. We spend time with our clients to understand their business, underlying questions, and tax implications. This enables us to develop optimum transfer pricing solutions with and for our clients.

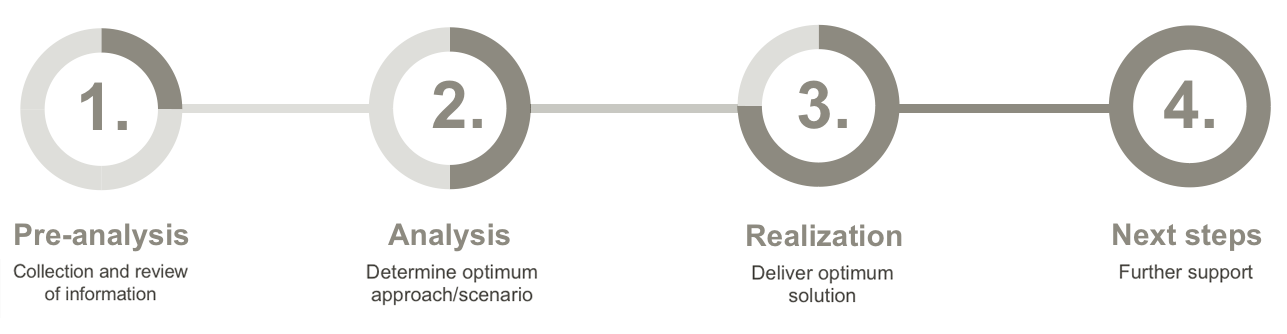

This translates into our typical 4-step approach:

Director

“At Quantera Global, we like to analyse complex matters in detail and translate difficult TP questions in a practical solution that helps our clients. My knowledge in the field of international taxation helps to establish a link between TP matters and international tax issues. This results in a high-quality answer to strategic questions of our clients.”