Transfer Pricing Implementation

The services QG offers include the implementation and documentation of transfer pricing policies as well as financial transactions. Monitoring the correct transactions is also part of our service.

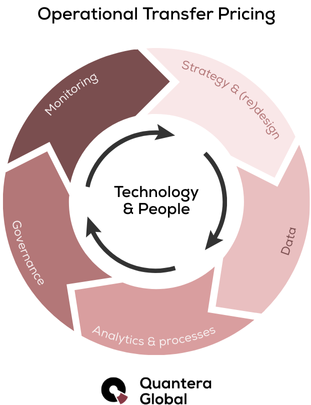

Let’s dive into the operational transfer pricing topics:

The definition of operational transfer pricing is:

“The practice of doing everything necessary to price individual intercompany transactions, and to accurately reflect transfer pricing policies in the administration and financial results of the parties involved.”

Once your transfer pricing policy/design has been determined, it is important that this policy is implemented in the organisation in a correct manner and in a way that suits your administrative processes. Operational transfer pricing software can help. The next step is therefore transfer pricing implementation.

Receive the full webinar recording and a practical guide in your inbox via the form.

These are the main benefits of actually implementing a transfer pricing strategy. We realize that your company might need some help in setting this up. Fortunately, we are here to help.

We provide full transfer pricing implementation services including:

If you would like to discuss how we can be of service to you, please make an appointment for a free consultation by phone or fill in our contact form. We are looking forward to meeting you.

Managing Director

Access our in-depth webinar and whitepaper, covering all you need to know about Operational Transfer Pricing. Get access now!