The timely preparation of Transfer Pricing documentation has become a significant part of the compliance burden of SME’s and MNE’s. A Transfer Pricing specialist can support and optimize the process.

Intercompany loans

Intercompany loans are an important instrument in Transfer Pricing. Here’s everything you need to know about intercompany lending:

- What are intercompany loans?

- How do intercompany loans work?

- Advantages of intercompany lending

- Agreements template

- Tax implications of intercompany loans

- Intercompany loans interest rates

- How our Transfer Pricing services support you with your intercompany loans?

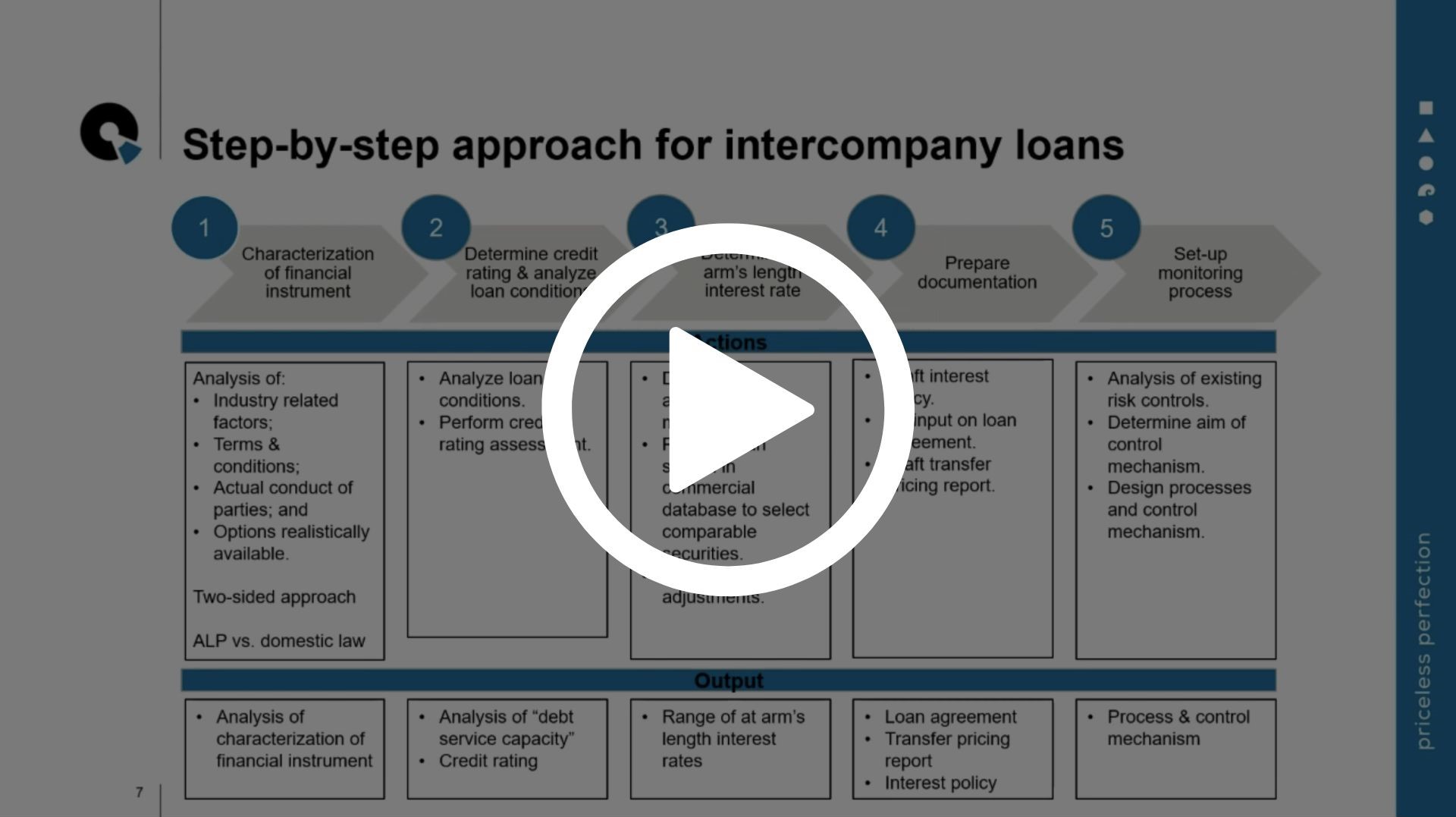

- Free webinar: step-by-step approach for intercompany loans

Want to know more about Intercompany loans?

Get in touchWhat are intercompany loans?

Intercompany loans are loans from one entity to another, within the same company.

These loans are a common tool used by multinational corporations or groups of companies to manage cash flow, fund operations, or allocate resources more efficiently across the organization.

How do intercompany loans work?

An intercompany loan works similarly to a bank loan. One entity owes intercompany debt – which is a financial obligation – to another entity within the same group.

However, since the transaction occurs within the organization, companies must maintain records to document the loan details (e.g. terms, payments) and ensure compliance with regulations.

In other words, intercompany loans are treated as formal financial transactions within a corporate group and must be handled in a manner that complies with accounting standards, tax laws, and regulatory requirements.

Watch our webinar with a step-by-step approach for intercompany loans:

Advantages of intercompany lending

Intercompany lending offers multiple advantages, such as quickly shifting cash between entities or avoiding bank fees and spreads. In addition, you can determine the terms and conditions yourself, as long as they are commercially sound (in line with the arm’s length principle) and do not depend on the terms and credit applications of banks/ commercial lenders. The loan should have an appropriate business rationale and be of interest for both entities/ sides to the transaction.

Agreements template

Intercompany loans need to be documented. Such an agreement is a formal, written contract between two entities within the same corporate group that outlines the terms and conditions of a loan provided by one entity to another.

Looking for an intercompany loan agreement template? We are here to help you with creating such an agreement. Simply reach out.

Tax implications of intercompany loans

There is an increasing interest in intercompany financing from the tax authorities. This is partially due to the guidelines published by the OECD. Chapter X of the Transfer Pricing Guidelines provides specific guidance on financial transactions, such as intercompany loans.

It is very well possible that the use of intercompany loans results in tax consequences, causing tax problems or other issues if not handled properly. The entity receiving the loan will have interest expenses, while the issuing entity will have interest income. This is subject to tax rules. The main challenge here may be determining the interest rates.

Want to know more about intercompany loans?

Get in touch

Intercompany loans interest rates

Interest rates should be market driven in accordance with an at arm’s length price, which means the interest is determined as though the debt were being established between unrelated parties.

Intercompany loans are subject to specific principles to derive the at arm’s length price, which are laid down in the OECD Guidelines mentioned above.

An important aspect of the new guidelines is the inclusion of more methods to determine the at arm’s length interest rate of intercompany loans, such as credit default swaps and economic modelling.

When interest rates are not properly set, the interest paid on the loan may not be deducted as an expense, while the lender has to pay tax on the interest income. Quantera Global helps to avoid risks like these.

How our Transfer Pricing services support you with your intercompany loans

Quantera Global:

- Meets the transfer pricing compliance requirements

- Prepares robust transfer pricing documentation

- Sets an at arm’s length price for your intercompany loan

- Conducts an analysis and benchmark study including credit rating (if required)

- Ensures that you are not faced with any surprises

- Sets up a monitoring process and risk control mechanisms

- Ensures that you can quickly provide your input to the treasury department

- Sets up a transfer pricing policy and related mechanisms that allow you to quickly assess what interest rate and terms should apply to new intercompany loans

- Provides answers so you can easily answer questions you may receive on your intercompany loans

- Explains the background to our analysis and documentation so that you are comfortable explaining if questions arise

- Allows you to balance compliance, your risk profile and cost efficiency

- Explains the pros and cons of potential solutions, so you can make an informed decision about which solution suits you best.

For our technical readers; we can apply multiple methods and use various databases when determining interest rates. Methods include a CUP analysis for loan and bond data, Yield curve analyses, economic models to determine interest rates and fund analysis costs.

If you would like to discuss how we can be of service to you, please make an appointment for a free consultation by phone or fill in our contact form. We are looking forward to meeting you.