Tomorrow, Quantera Global together with Advance Tax Compliance will organize a webinar regarding “Operational Transfer Pricing”. A booming topic which gains increasing interest from finance and tax departments of multinational companies.

During this webinar, we will touch upon the key aspects of operational transfer pricing and present a process how to identify and realize your optimal solution in this field. The process starts with the data in your systems up to and including software that is able to create the desired insights and overviews, including monitoring and control capabilities. Practical experience on operational transfer pricing will be shared by an in-house tax professional of a multinational company. If you would like to join this free-of-charge webinar, please send a short e-mail to QGAcademy@quanteraglobal.com.

Below we have included some first remarks on “Operational Transfer Pricing”.

Operational transfer pricing can generally be described as all what is necessary to ascertain that your transfer pricing policy is effectively implemented in business and finance and is working in and for the company.

The ability to prove that you are in control on transfer pricing has gained increasing attention since the start of the BEPS action plan in 2013. Certainly for transfer pricing, discussions with stakeholders such as tax authorities have transformed from “tell me” to “show me”.

The above triggers or, to our expectation, will trigger finance and tax departments to analyse their current processes and control mechanisms, and to look for potential improvements, efficient automation and software solutions.

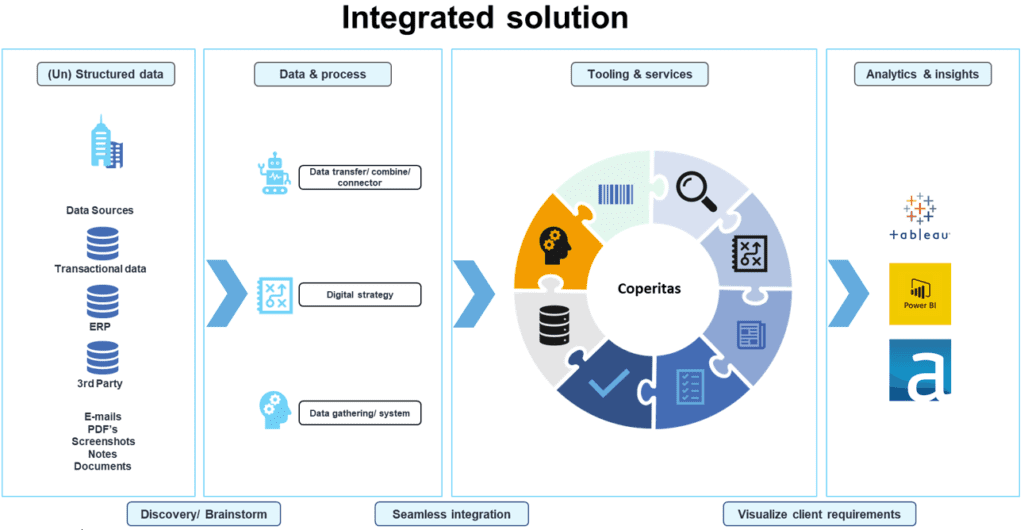

Quantera Global’s mission is to ascertain that our clients themselves are in control in the field of transfer pricing. We have therefore, since our start in 2013, invested to be able to provide the optimal support in operational transfer pricing. We invested in the required expertise, the development of a transfer price software solution (www.coperitas.com) and with a partner in expertise and related solutions to realize the process, controls and automation you need.

Given the increased transfer pricing compliance requirements, transparency and technological possibilities, we believe this is the right moment to take the first step as a finance and tax department.

A first step would be to describe the current process and analyse potential improvements. This analysis leads to insight in your optimal process, desired controls and which steps are needed to get there.

Such an analysis can be a good starting point and does not have to take a lot of time and capacity. To our experience this can be organized in a few weeks and leads to valuable insights.

An overview of an integrated solution is given below.

Interested in what we can do for you? We offer an exploration meeting of 2 hours so you can make an informed decision on your journey. Contact your Quantera Global contactperson or send an e-mail to info@quanteraglobal.com.