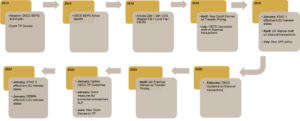

In the past 10 years there have been major developments in the Dutch transfer pricing landscape. From the Dutch TP decree issued in November 2013 to a new Dutch TP decree in 2022. Or the implementation of the Master File and Local file in the Dutch corporate income tax act in 2016 and the OECD guidance on financial transactions in 2020. The main developments have been depicted in the overview below:

Looking back at 2022 we can say that it was quite an interesting year from a transfer pricing development point of view. In 2022 a new Dutch decree on transfer pricing was issued, which replaced the Dutch Decree of 2018. The biggest changes to the decree are included in the section on financial transactions, including the reflection of the OECD’s guidance on financial transactions in Chapter X of the OECD guidelines:

- Intercompany loans

- Financial service entities

- Financial guarantees

- Cash pooling

- Control over risk

- Intercompany services

The decree furthermore contains a specific paragraph which allows the tax-inspector in certain cases to deviate from the policy in the decree in case there is a risk of double non-taxation.

We expect that the Dutch tax authorities will pay more attention to “control over risk”. An entity should be able to control and manage the risks (e.g., credit risks, market risks and operational risks). The entity must have sufficient financial capacity to bear negative consequences of the risks if they materialize.

What can you expect for the future?

Some important developments are coming in the next years. Last December Pillar 2 was adopted by the EU, so that will also be implemented in this year.

In 2024 ATAD 3 will be effective in EU member states. This is a Directive (ATAD 3) to combat (tax) abuse of shell companies, letterbox companies and flow-through companies. Furthermore DEBRA (debt-equity bias reduction allowance) will be effective which aims to encourage companies to invest with equity rather than debt.

Do you want more information on ATAD 3, DEBRA or any other transfer pricing topic, then please do not hesitate to contact us.