Transfer pricing methods for intercompany transactions

Transfer pricing ensures that transactions between associated entities comply with international tax laws. There are several transfer pricing methods available, each suited to different scenarios and compliance needs. Here’s an overview of the most important transfer pricing methods:

- Cost Plus Method

- Transactional Net Margin Method (TNMM)

- Resale Minus Method (Resale Price Method)

- Comparable Uncontrolled Price (CUP) Method

- Profit Split Method

Not sure which method you should use? Get a free Transfer Pricing scan to double check your decision:

Want to know more about Transfer pricing methods for intercompany transactions?

Get in touchWhich transfer pricing method to apply

Selecting the appropriate transfer pricing method is crucial for compliance and operational efficiency in intercompany transactions. Each transfer pricing method, serves different scenarios and compliance needs. By understanding the characteristics and applications of these methods, MNEs can ensure fair and compliant transfer pricing practices.

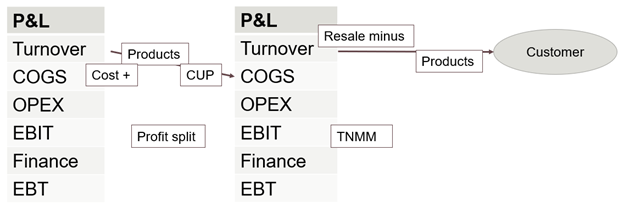

In the simplified chart below the methods are depicted and the figure that is mainly used to calculate the related intercompany pricing.

Dependent on the countries involved and various roles of entities, you can determine which strategy to apply in this respect.

Legislative and cultural differences, as well as the structure of the company, play a significant role in determining the optimal price setting and testing strategy.

For example, extracting profit/cash out from countries like China can be challenging due to regulatory and cultural factors. Therefore, understanding these nuances is essential for effective transfer pricing.

When determining which transfer pricing method to apply, it is crucial to distinguish between price setting and price testing methods.

Webinar: Transfer pricing aspects of financial transactions

Price setting: traditional transaction methods

The OECD distinguishes traditional transaction methods and transactional profit methods. Theoretically traditional transaction methods are preferred, however in practice transactional profit methods are most commonly applied.

Traditional transaction methods are not often applied as (ultimate) Transfer Pricing method due to various disadvantages and reliability issues. The theory behind these methods can however often be used for price setting purposes to achieve an approximate profit level.

Traditional transaction methods compare the intercompany price with the external price of a product or service (gross margin for Cost Plus Method and Resale Minus Method, or direct product/service price for Comparable Uncontrolled Price (CUP) Method).

Traditional transaction methods:

These methods can then be adjusted to align with the profit agreed upon by the parties for final price testing.

Price testing: transactional profit methods

Transactional profit methods compare the total profit for a type of activity with the total profit of a third party (TNMM) for the same activity or intends to split the profit fairly between parties (profit split).

Transactional profit methods:

Of all transfer pricing methods, the TNMM is most often used due to data availability and to avoid information disadvantage for tax authorities.

Our greatest success is your success.

"Quantera Global is the specialist in transfer pricing reporting. They provide us with the extra knowledge to produce the master and local files. Communication is clear and direct."

"Quantera Global has excellent knowledge of transfer pricing and understands the customer's situation. Questions are carefully considered, so that a response is given as concretely as possible and in understandable language for the client."

Where does each Transfer Pricing Method sit within the P&L?

Each transfer pricing method aligns differently within a profit and loss (P&L) statement, reflecting its purpose and application.

Each plays a unique role, impacting turnover, COGS, or EBIT. The choice of method depends on transaction specifics, data availability, and regulatory requirements.

Understanding where transfer pricing methods sit within the P&L helps businesses to achieve better compliance, strategic clarity, navigate global tax requirements and optimize operations.

| TP Method | P&L Level | Primary Focus |

| Resale Minus | Turnover/Gross Profit | Distributor margin and OPEX coverage |

| Cost Plus | COGS | Procurement costs and markup |

| CUP | Turnover | Market price comparability |

| Profit Split | EBIT | Collaborative profit allocation |

| TNMM | EBIT | Operating profit comparison |

Whether it’s the precision of CUP, the flexibility of TNMM, or the balance of the Profit Split, each method has its unique role in aligning financial reporting with economic substance. Implementing the right method fosters transparency, compliance, and profitability.

FAQ Transfer Pricing Methods

Can multiple Transfer Pricing Methods be used for one business?

Yes, companies often use a mix of methods to suit different transaction types and ensure compliance.

Need help picking the right transfer pricing method?

If you’re looking to simplify your transfer pricing while enhancing compliance and sustainability, consider reaching out for a non-committal initial check.

Understanding and applying the right transfer pricing methods can significantly impact your company’s financial health and regulatory compliance.

White paper: Transfer Pricing for Multinational Enterprises

Want to have an in-depth document with actionable steps on how to improve transfer pricing? Download our whitepaper about Transfer Pricing for MNE’s by Quantera Global!

We are here of you need a:

We are here of you need a:

Learn more about Transfer Pricing Methods

Did we leave your question unanswered? Let us know! Ask you question in a free phone consultation or use our contact form. We are looking forward to meeting you. In the meantime you can subscribe to our Transfer Pricing newsletter.