Transactional Net Margin Method (TNMM)

The Transactional Net Margin Method (TNMM) is the most popular Transfer Pricing Method. It’s widely applied across industries due to its ease of application, effectiveness, and typically reduced chance of scrutiny.

TNMM examines the net profit margin relative to a base such as costs, sales, or assets that a taxpayer realizes from a controlled transaction. It ensures that the profitability of related-party transactions aligns with the arm’s length principle—treating related parties as if they were unrelated.

TNMM is generally applied when:

- No Comparable Uncontrolled Price (CUP) exists due to unique transactions or a lack of reliable data.

- One party performs routine, low-risk functions that are easy to benchmark.

- Other methods (like Resale Minus or Cost Plus) are difficult to apply or defend.

This method is especially useful when one of the entities performs routine functions (e.g. contract manufacturing, limited-risk distribution, or shared services).

Want to know more about Transactional Net Margin Method (TNMM)?

Get in touchHow the Transactional Net Margin Method (TNMM) works

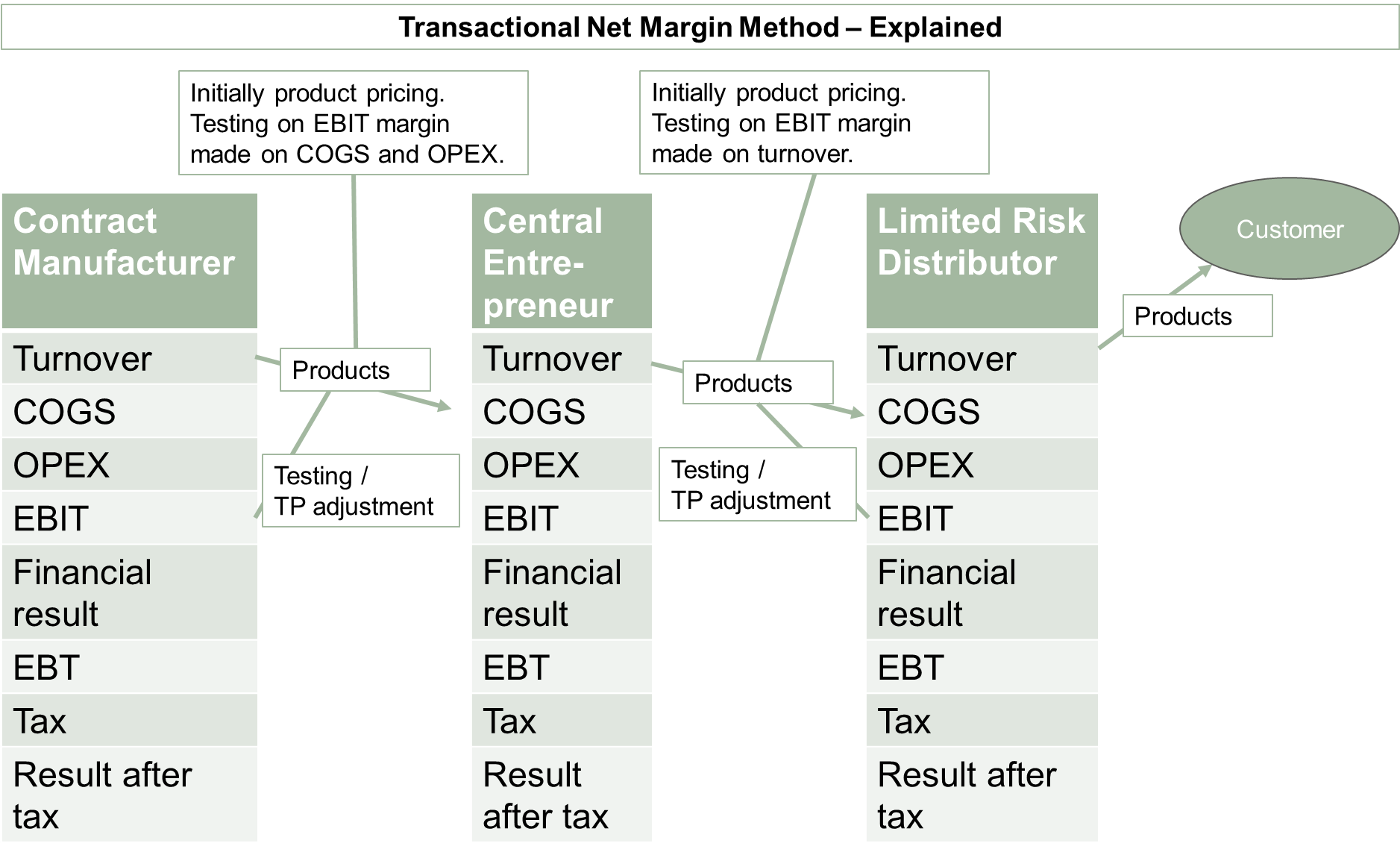

TNMM compares the operating profit (EBIT) of the tested party with the EBIT margins of comparable independent companies.

A Profit Level Indicator (PLI)—often cost-based or turnover-based—is selected depending on the function performed.

A benchmark study is conducted using financial databases to find suitable comparables.

The resulting benchmark range (e.g. median EBIT/cost margin) is used to determine if the tested party’s results are at arm’s length.

If the tested entity performs multiple routine services, a segmented P&L is prepared to evaluate each function separately.

The Comparable Profits Method (CPM) is the U.S. IRS equivalent of TNMM under the OECD Guidelines. Both aim to assess whether the net margin of a tested party is in line with independent comparables performing similar functions.

Webinar: Transfer pricing aspects of financial transactions

Comparison: TNMM vs. Cost Plus

The Cost Plus Method applies a gross mark-up to, for example, costs of goods procured, while TNMM with the Net Cost Plus Margin evaluates profitability at the EBIT level on a net margin. The Operational Expenses are as such also considered for the TNMM and not for the Cost Plus Method.

| TNMM | Cost Plus |

|---|---|

| Net margin based (EBIT) | Gross margin based (before OPEX) |

| Operational expenses included | OPEX excluded |

| Benchmarked on EBIT/Costs or EBIT/Sales | Based on markup on direct costs |

| Used for routine functions, tested on a net basis | Used for price setting or internal cost markup |

TNMM - P&L placement

TNMM testing takes place at the EBIT level. It often uses cost or turnover as the base, depending on whether the tested party is a cost center (e.g. service provider) or revenue generator (e.g. distributor).

Our greatest success is your success.

"Quantera Global is the specialist in transfer pricing reporting. They provide us with the extra knowledge to produce the master and local files. Communication is clear and direct."

"Quantera Global has excellent knowledge of transfer pricing and understands the customer's situation. Questions are carefully considered, so that a response is given as concretely as possible and in understandable language for the client."

Why is TNMM widely used in transfer pricing?

TNMM is:

• Easy to apply

• Leaves relatively small results for routine entities

• Prevents losses in multiple jurisdictions

• Typically tax efficient while reducing chances on audits

Tax authorities have an information disadvantage and can more easily dispute other TP methods than the TNMM. It’s often more difficult for tax authorities to judge whether the entity in their jurisdiction is responsible for, for example, losses, or whether that’s caused by factors like budgeting.

This makes that tax authorities are typically in favor of this method. In addition, the easiest way to increase your tax cash out is to have losses in multiple jurisdictions and (assuming a profitable group) consequently high profits in other jurisdictions. The TNMM ensures a small profit in various routine entities and that the residual result is centralized.

In addition, it is relatively easy to implement and maintain, and can be applied to most function/service types.

Pros and Cons of Transactional Net Margin Method

Pros of TNMM

➕ Widely accepted by both tax authorities and taxpayers

➕ Predictable results for routine service or distribution entities

➕ Applicable across industries and functions

Cons of TNMM

➖ Less insight into actual entity performance

➖ Limited incentive for operational improvement (net margin is pre-set)

➖ Not always suitable for unique/high-value transactions or intangibles

These limitations can sometimes be addressed through internal management reporting—but they remain a consideration in method selection.

Need help picking the right transfer pricing method?

If you’re looking to simplify your transfer pricing while enhancing compliance and sustainability, consider reaching out for a non-committal initial check.

Understanding and applying the right transfer pricing methods can significantly impact your company’s financial health and regulatory compliance.

White paper: Transfer Pricing for Multinational Enterprises

Want to have an in-depth document with actionable steps on how to improve transfer pricing? Download our whitepaper about Transfer Pricing for MNE’s by Quantera Global!

We are here of you need a:

We are here of you need a:

Learn more about the TNMM method

Did we leave your question unanswered? Let us know! Ask you question in a free phone consultation or use our contact form. We are looking forward to meeting you. In the meantime you can subscribe to our Transfer Pricing newsletter.