Profit Split Method

The Profit Split Method is a Transfer Pricing Method. It allocates the combined profits (or losses) between related entities based on their respective contributions. The PSM method provides a balanced approach for integrated operations, such as joint product development.

The Profit Split Method (PSM) is ideal for transactions involving high interdependence, such as shared development of intellectual property.

Want to know more about Profit Split Method?

Get in touchHow the Profit Split Method works

In the Profit Split Method, rofits are split proportionally, considering:

- Functions performed

- Assets used

- Risks undertaken

The method is often used in highly integrated business operations, where development efforts are shared between multiple entities.

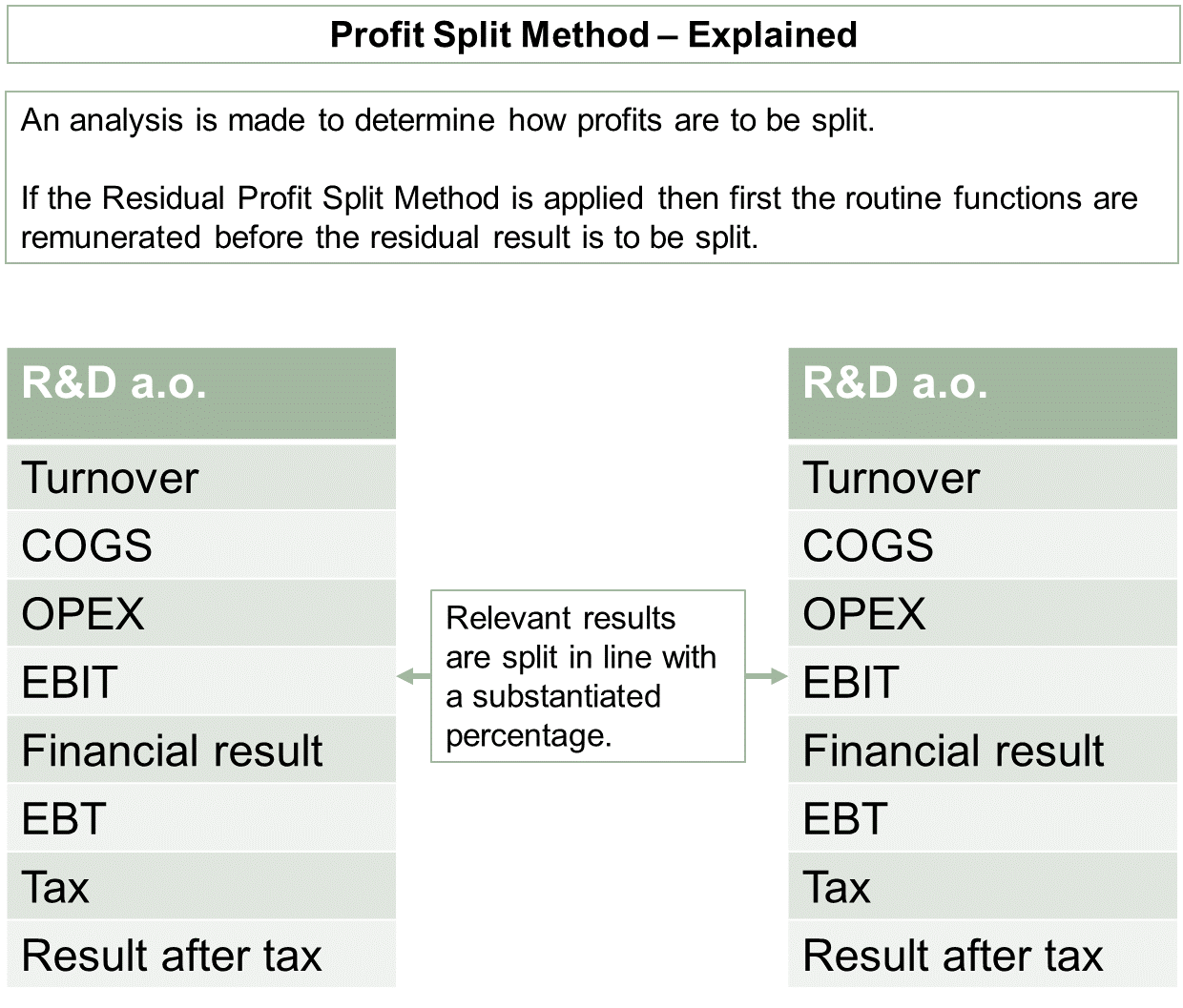

The residual profit split method is a variation where routine returns are assigned first, and the remaining profit is split based on value contributions

Webinar: Transfer pricing aspects of financial transactions

Profit Split Method - P&L placement

The Profit Split Method affects the EBIT (Earnings Before Interest and Taxes) level. It evaluates the total profitability of a controlled transaction across entities and splits it accordingly.

Our greatest success is your success.

"Quantera Global is the specialist in transfer pricing reporting. They provide us with the extra knowledge to produce the master and local files. Communication is clear and direct."

"Quantera Global has excellent knowledge of transfer pricing and understands the customer's situation. Questions are carefully considered, so that a response is given as concretely as possible and in understandable language for the client."

Need help picking the right transfer pricing method?

If you’re looking to simplify your transfer pricing while enhancing compliance and sustainability, consider reaching out for a non-committal initial check.

Understanding and applying the right transfer pricing methods can significantly impact your company’s financial health and regulatory compliance.

White paper: Transfer Pricing for Multinational Enterprises

Want to have an in-depth document with actionable steps on how to improve transfer pricing? Download our whitepaper about Transfer Pricing for MNE’s by Quantera Global!

We are here of you need a:

We are here of you need a:

Learn more about the Profit Split Method

Did we leave your question unanswered? Let us know! Ask you question in a free phone consultation or use our contact form. We are looking forward to meeting you. In the meantime you can subscribe to our Transfer Pricing newsletter.