CUP method

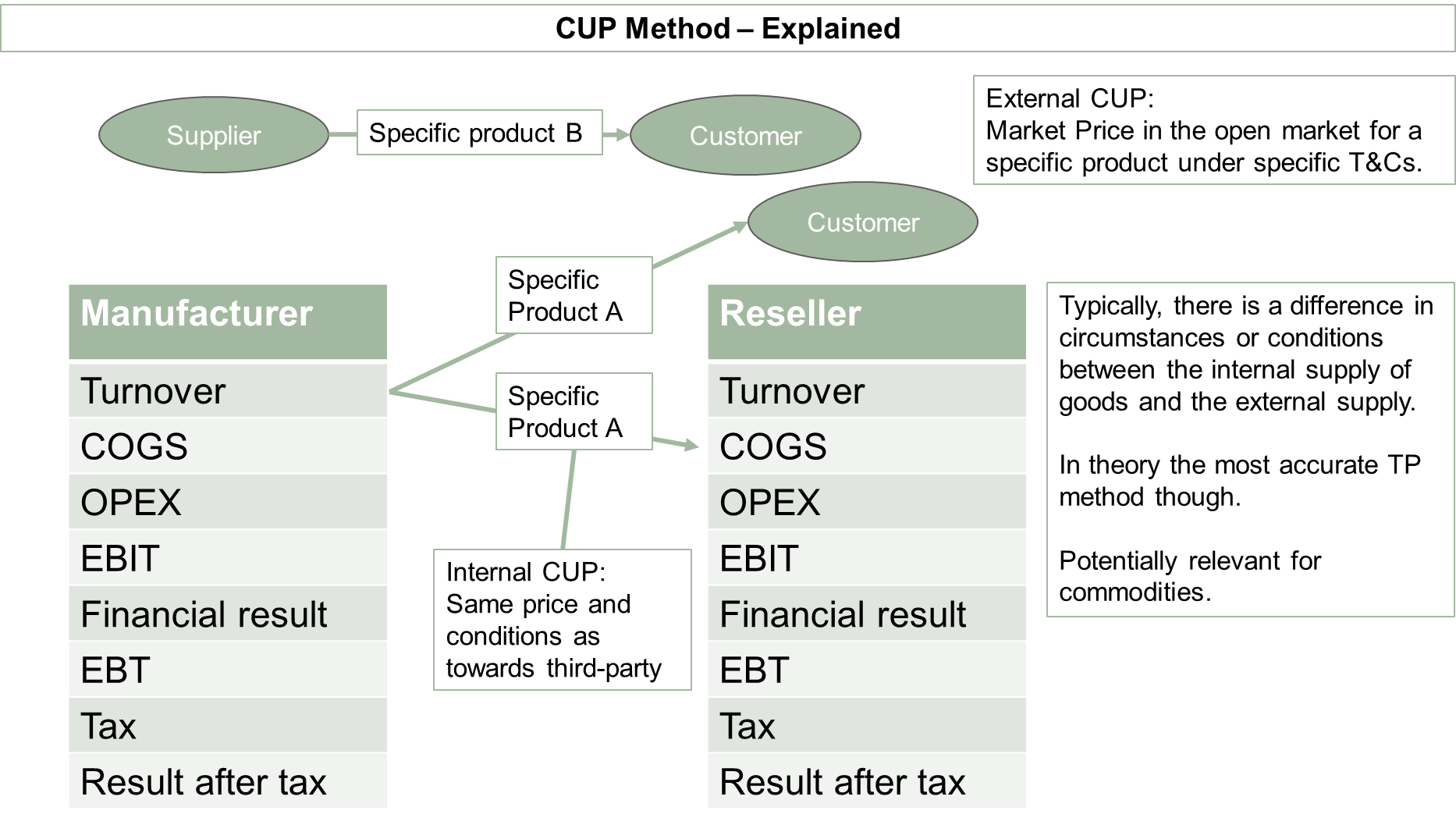

The Comparable Uncontrolled Price (CUP) Method is a Transfer Pricing Method. It directly compares intercompany prices of a specific product under comparable circumstances and conditions to those of third-party transactions. When applicable, CUP provides the most precise measure of arm’s length pricing.

By directly comparing prices with third-party transactions, CUP establishes a similar price for a similar product and with a similar quantity and terms as charged towards third parties or in the open market. That’s how CUP ensures fair pricing.

Want to know more about CUP method?

Get in touchHow the CUP Method works

A product price is established based on comparable transactions in the open market (external CUP) or with third-party customers (internal CUP).

CUP ensures pricing is aligned with what independent parties would have charged under similar terms.

It is especially common in financial transactions, where benchmark studies are often referred to as using the CUP method—though one could question whether these truly meet the formal CUP standard.

Webinar: Transfer pricing aspects of financial transactions

Challenges

The Comparable Uncontrolled Price method comes with it’s challenges:

- Deviations in product quality, volume, or contractual terms can limit the applicability of the CUP method.

- Because it requires near-perfect comparability, CUP is often harder to apply in practice than other methods.

CUP Method - P&L placement

CUP operates primarily at the turnover level, by ensuring that revenue from intercompany transactions reflects an arm’s length price.

Our greatest success is your success.

"Quantera Global is the specialist in transfer pricing reporting. They provide us with the extra knowledge to produce the master and local files. Communication is clear and direct."

"Quantera Global has excellent knowledge of transfer pricing and understands the customer's situation. Questions are carefully considered, so that a response is given as concretely as possible and in understandable language for the client."

Need help picking the right transfer pricing method?

If you’re looking to simplify your transfer pricing while enhancing compliance and sustainability, consider reaching out for a non-committal initial check.

Understanding and applying the right transfer pricing methods can significantly impact your company’s financial health and regulatory compliance.

White paper: Transfer Pricing for Multinational Enterprises

Want to have an in-depth document with actionable steps on how to improve transfer pricing? Download our whitepaper about Transfer Pricing for MNE’s by Quantera Global!

We are here of you need a:

We are here of you need a:

Learn more about the CUP Method

Did we leave your question unanswered? Let us know! Ask you question in a free phone consultation or use our contact form. We are looking forward to meeting you. In the meantime you can subscribe to our Transfer Pricing newsletter.