Transfer Pricing Methods

What you will find on this page:

-

Quick Links will be displayed here

Transfer pricing methods for intercompany transactions

Transfer pricing ensures that transactions between associated entities comply with international tax laws. There are several transfer pricing methods available, each suited to different scenarios and compliance needs. Here’s an overview of the most important transfer pricing methods:

- Cost Plus Method

- Transactional Net Margin Method (TNMM)

- Resale Minus Method (Resale Price Method)

- Comparable Uncontrolled Price (CUP) Method

- Profit Split Method

Not sure which method you should use? Get a free Transfer Pricing scan to double check your decision:

Want to know more about Transfer pricing methods for intercompany transactions?

Maikel Verhoeven

Managing Director

Which transfer pricing method to apply

Selecting the appropriate transfer pricing method is crucial for compliance and operational efficiency in intercompany transactions. Each transfer pricing method, serves different scenarios and compliance needs. By understanding the characteristics and applications of these methods, MNEs can ensure fair and compliant transfer pricing practices.

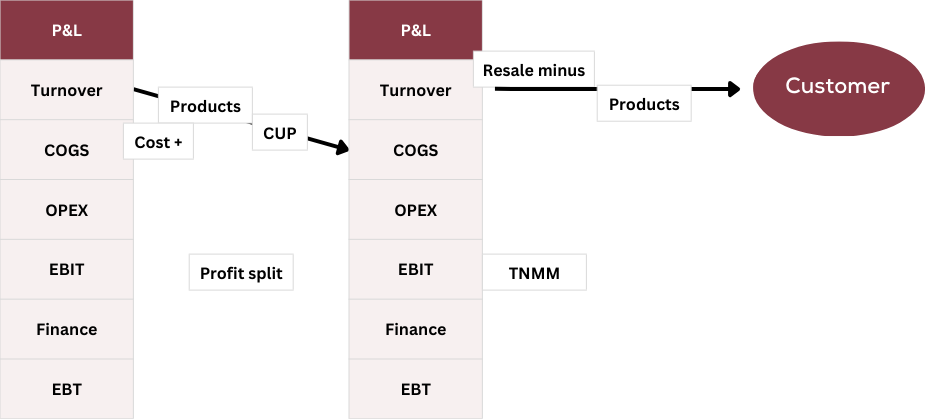

In the simplified chart below the methods are depicted and the figure that is mainly used to calculate the related intercompany pricing.

Dependent on the countries involved and various roles of entities, you can determine which strategy to apply in this respect.

Legislative and cultural differences, as well as the structure of the company, play a significant role in determining the optimal price setting and testing strategy.

For example, extracting profit/cash out from countries like China can be challenging due to regulatory and cultural factors. Therefore, understanding these nuances is essential for effective transfer pricing.

When determining which transfer pricing method to apply, it is crucial to distinguish between price setting and price testing methods.

Price setting: traditional transaction methods

The OECD distinguishes traditional transaction methods and transactional profit methods. Theoretically traditional transaction methods are preferred, however in practice transactional profit methods are most commonly applied.

Traditional transaction methods are not often applied as (ultimate) Transfer Pricing method due to various disadvantages and reliability issues. The theory behind these methods can however often be used for price setting purposes to achieve an approximate profit level.

Traditional transaction methods compare the intercompany price with the external price of a product or service (gross margin for Cost Plus Method and Resale Minus Method, or direct product/service price for Comparable Uncontrolled Price (CUP) Method).

Traditional transaction methods:

These methods can then be adjusted to align with the profit agreed upon by the parties for final price testing.

Price testing: transactional profit methods

Transactional profit methods compare the total profit for a type of activity with the total profit of a third party (TNMM) for the same activity or intends to split the profit fairly between parties (profit split).

Transactional profit methods:

Of all transfer pricing methods, the TNMM is most often used due to data availability and to avoid information disadvantage for tax authorities.

What our clients say about us

Guided TP model improvement

Quantera has been with us since the start of the overhaul of our TP model. With the help of Quantera we were able to ask the right questions and also got the business thinking about where their value really sits. This journey has left us being much better in control. They maintain a good overview of outstanding issues and pro-actively contribute to resolve issues.

Jord Ruijgh

Head of Tax & Treasury at Meltwater

Cooperative global TP services

Quantera Global provides us with excellent transfer pricing services, which we use as part of our propositions towards our global clients. We appreciate their open and cooperative style of working together. They are always available to brainstorm on tp matters, discuss practical approaches and provide global insights.

Bart Le Blanc

Partner at Norton Rose Fulbright LLP

Timely project delivery

Quantera Global has assisted us in a transfer pricing documentation project that needed to be dealt with at a short notice. We appreciate their delivery capacity and proper and timely feedback.

Erwin Beermann

CFO at FibrXL

Where does each Transfer Pricing Method sit within the P&L?

Each transfer pricing method aligns differently within a profit and loss (P&L) statement, reflecting its purpose and application.

Each plays a unique role, impacting turnover, COGS, or EBIT. The choice of method depends on transaction specifics, data availability, and regulatory requirements.

Understanding where transfer pricing methods sit within the P&L helps businesses to achieve better compliance, strategic clarity, navigate global tax requirements and optimize operations.

| TP Method | P&L Level | Primary Focus |

|---|---|---|

| Resale Minus | Turnover/Gross Profit | Distributor margin and OPEX coverage |

| Cost Plus | COGS | Procurement costs and markup |

| CUP | Turnover | Market price comparability |

| Profit Split | EBIT | Collaborative profit allocation |

| TNMM | EBIT | Operating profit comparison |

Whether it’s the precision of CUP, the flexibility of TNMM, or the balance of the Profit Split, each method has its unique role in aligning financial reporting with economic substance. Implementing the right method fosters transparency, compliance, and profitability.

Can multiple Transfer Pricing Methods be used for one business?

Yes, companies often use a mix of methods to suit different transaction types and ensure compliance.

Need help picking the right transfer pricing method?

If you’re looking to simplify your transfer pricing while enhancing compliance and sustainability, consider reaching out for a non-committal initial check.

Understanding and applying the right transfer pricing methods can significantly impact your company’s financial health and regulatory compliance.

How can we help you?

Fill out the contact form or visit our FAQ.